What is CSRD?

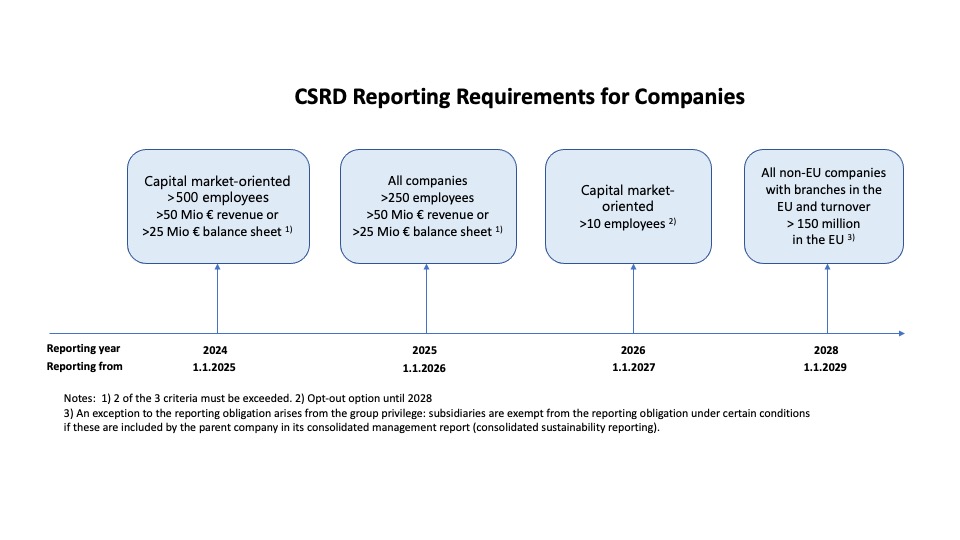

In accordance with the EU’s December 2022 EU Corporate Sustainability Reporting Directive (CSRD) large, medium-sized (>250 employees) and listed companies >10 employees must in future publish an annual “Non-Financial Report” (often also referred to as a “Sustainability Report” or “CSR report”) as part of the Management Report and and also have it audited externally.

This significantly expands European accounting law, meaning that in future companies affected by CSRD will be subject to an ESG disclosure obligation in addition to the financial disclosure obligation. In the EU, the Non-Financial Reporting Directive (NFRD), which was implemented in Austria in the Sustainability and Diversity Improvement Act (NaDiVeG), has already required large companies to prepare a Non-Financial Report since 2017. However, there were hardly any requirements in terms of content, meaning that the information disclosed was hardly comparable. Furthermore, there was no requirement for an external audit.

With the CSRD regime, the EU has now defined very detailed reporting requirements so that, together with the newly introduced external audit requirement for reports, it will be difficult for companies to “whitewash” their sustainability reports. The CSRD regime is based on the idea of “sustainable finance”. Accordingly, the EU’s plan is to put a price on sustainability and thus create incentives for companies to adapt their behavior. In this context, there is a link to the EU Taxonomy Regime (EU Taxonomy Regulation), which defines the criteria for Sustainable Management by companies.

The aim of CSRD and Taxonomy is to steer investment flows towards sustainability and thus solve the problems of climate change and social injustice, among others. As the entire value chain must be covered by the companies concerned in the CSRD reports, companies not subject to CSRD (suppliers) will also be indirectly guided towards more sustainable behavior.

Who is affected by the CSRD?

The reporting obligation under the CSRD applies to all companies that meet at least two of the three size criteria:

In addition, all listed companies are affected (including certain SMEs). However, a separate proportionate standard will be developed for SMEs and the obligations will only apply three years later.

The timetable provides for a gradual introduction of the reporting obligations:

CSRD reporting – scope and content

In contrast to previous reporting in accordance with the NFRD, reporting now follows the logic of “ESG” – environmental, social and governance. What is new is the emphasis on the “governance pillar”, which primarily addresses specific duties for the Management Board and Supervisory Board and focuses on good corporate governance on the one hand and the integration of ecological and social aspects on the other. According to the CSRD, reporting must include the following points/topics:

General disclosures

Topic-specific disclosures

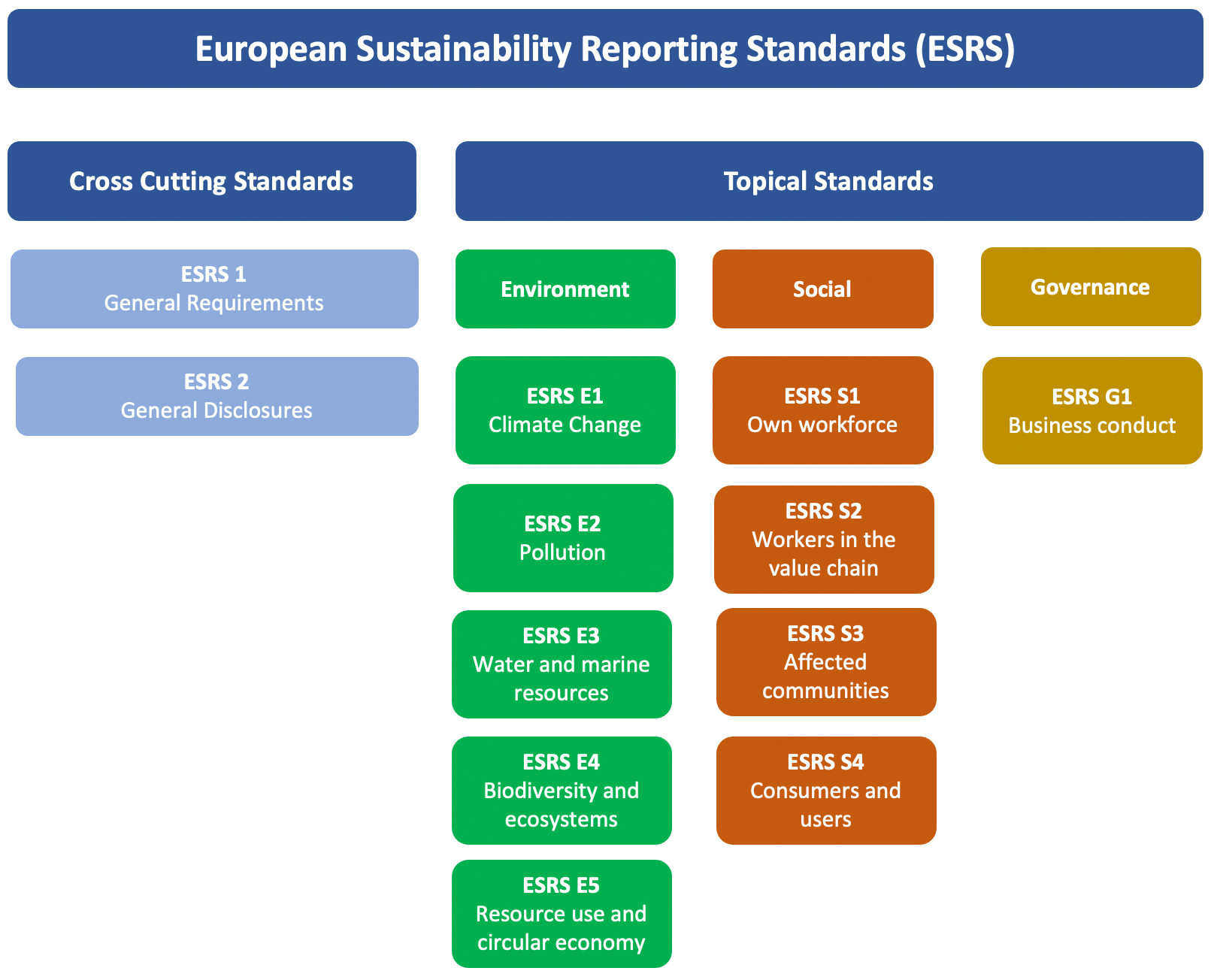

The specific content of the reporting was delegated by the EU Commission to the EFRAG (European Financial Reporting Advisory Group), which published the overarching and thematic 12 European Sustainability Reporting Standards (ESRS) in 2023, which were adopted by the EU Commission on July 31, 2023. As delegated acts, these standards are binding in all member states.

The thematic standards deal with sustainability aspects in the areas of environment (ESRS E1-E5), social affairs (ESRS S1-S4) and governance (ESRS G1). The content of E1-E5 reflects the EU’s six environmental objectives, which also provide the structure for the EU Taxonomy Regulation: climate change mitigation, climate change adaptation, water and marine resources, circular economy, pollution, biodiversity and ecosystems.

Standards S1-S4 summarize the information required on the social aspects of equal treatment, equal opportunities, working conditions and respect for human rights and fundamental freedoms.

The G1 standard requires governance aspects such as the role of the company’s administrative, management and supervisory bodies – also with regard to sustainability issues. In accordance with the ESRS standards, 1144 quantitative and qualitative data points are specified, which must be collected in a standardized manner and the performance of which must be reported. From a current perspective, it can be assumed that around 50-60% of the data points will be relevant for an average company.

The central point of the overarching requirements is the so-called double materiality. Accordingly, companies must provide information both on their impact on people and the environment (impact materiality) and on the financial risks and opportunities that social and environmental issues pose for the company (financial materiality).

The relevant disclosure requirements and data points from the ESRS must be subject to a materiality assessment. This means that the company only reports relevant information and can refrain from disclosing information that is not relevant (“material”) to its business model and activities. For example, if an entity concludes that climate change is not material and therefore omits the disclosures for this standard, it must provide a detailed explanation of the conclusions of its assessment of materiality in relation to climate change.

In addition to disclosing information on strategies and initiatives, the CSRD also requires companies to set sustainability targets and report on their progress. The link to the EU taxonomy is given by the fact that the ESRS standards require disclosure of information in accordance with the EU taxonomy, i.e. those companies that fall within the scope of the EU taxonomy must also report on the corresponding taxonomy requirements (e.g. taxonomy-eligible turnover as a percentage).

With the adoption of the ESRS, the EU Commission has made things easier for companies with fewer than 750 employees. Accordingly, the reporting obligation on individual topics can be postponed by 1-2 years for these companies. This concerns, for example, the inclusion of Scope 3 greenhouse gas emissions in the greenhouse gas balance.

With regard to the type of reporting, it is planned that in future this must be carried out electronically with digital tagging in accordance with the ESEF Regulation. This means that both financial and sustainability reports will in future be uploaded to an EU-wide digital database (“European Single Access Point”).

Review of the CSRD reports

In accordance with the requirements of the CSRD, an independent external review of the non-financial reports is mandatory on an annual basis. This audit can be carried out by auditors or certification bodies. For the time being, the audit must be carried out with “limited assurance”. For the next few years, the EU is planning to tighten this to “reasonable assurance”.

In any case, compliance with the ESRS is also part of the external review.

What impact does CSRD have on SMEs

With the exception of listed SMEs, CSRD is not applicable to SMEs. As the CSRD reporting obligation also covers aspects of the entire value chain, it is to be expected that companies affected by CSRD will demand information from their suppliers on ESG performance or improvements in ESG performance.

Similarly, SMEs not affected by CSRD will be asked for ESG information by banks, investors or other stakeholders. For this reason, EFRAG will also develop simplified voluntary standards for non-listed SMEs. These voluntary standards are designed to enable non-listed SMEs to respond to requests for ESG information in an efficient and proportionate manner, thereby encouraging their participation in the transition to a sustainable economy.

Support from risksafe ESG

Not just a compliance obligation, but a process for integrating ESG-related risks and opportunities into corporate strategy and reporting. This is primarily because CSRD virtually obliges companies to step up their efforts towards a sustainable future.

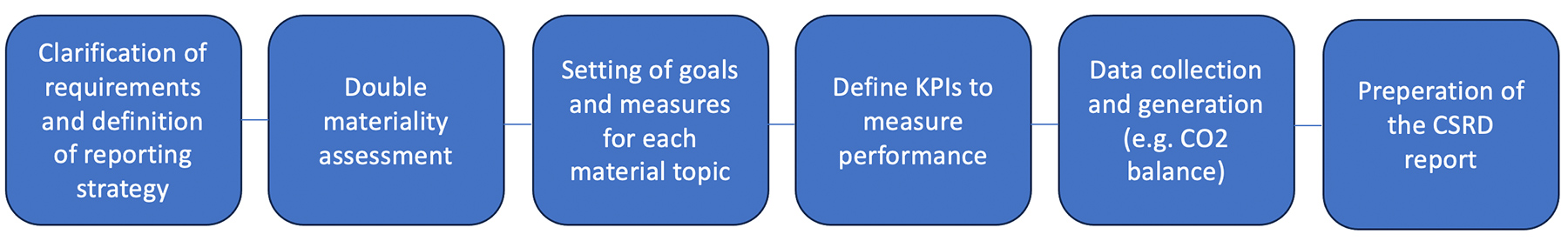

As a result, it can be assumed that a longer period of time will be required to implement the CSRD requirements. The companies concerned should therefore start preparing for the implementation of the CSRD as soon as possible in order to ensure the timely fulfillment of reporting obligations and the alignment of the sustainability strategy.

A practicable procedure for implementing the CSRD reporting obligation is shown below. Parallel to this, or successively after the initial reporting, we recommend setting up a Sustainability Management System in which all key tasks and responsibilities as well as the processes are defined (in writing).

Our offer

Take advantage of our experience – you won’t find a higher level of expertise!

We have many years of experience in all relevant ESG topics – including Environmental Verifier, CO2 Management, preparation and auditing of Sustainability Reports, Occupational Safety, Management Systems, Legal Compliance and Corporate Governance.